maine excise tax form

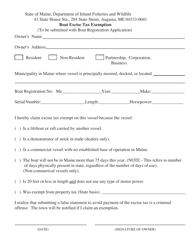

Boat Excise Tax Exemption Form. There are about 750 accounts including over 9 million taxable acres.

You can also call the dealership that the vehicle was purchased from.

. Wildlife Rehabilitator Annual Report Form 2019. When offering samples at a taste-testing festival. Clearly write the computed excise tax rate for the fuel blend.

How much is the excise tax. The MSRP is listed on your current registration form under Base. The rates drop back on January 1st of each year.

Gallons received from any source on which Maine excise tax has been paid. Multiply taxable gallons by the excise tax rate for the blend and enter the amount in the Tax column. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

YEAR 1 0240 mill rate. Commercial Forestry Excise Tax Return. The excise tax due will be 61080.

The age of the vehicle. Line 1 Marijuana Flower wet. 2 Low-alcohol spirits products excise tax 124gallon spirits products to Maine retailers.

Please contact our office 207-439-1817 with any questions or for assistance with the calculation of the excise tax due. Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or. HttpwwwmainegovsosbmvformsMV-720Active20Duty20Excise20Exemption20Formpdf To read the State law.

MAINE OFFICE OF TOURISM. Home of Record legal address claimed for tax purposes. Individual Vehicle Mileage and Fuel Report.

Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due. The amount of tax is determined by two things. When importing malt liquor into Maine.

The Form can be found at Bureau of Motor Vehicle Web site or the link below. Form 8864 Biodiesel and Renewable Diesel Fuels Credit PDF. Boat Registration Form Use Tax Certificate required for new registrations Boat Dealer Registration.

Clearly write the computed excise tax rate for the fuel blend. Line 3 Gallons Received Tax Unpaid. YEAR 3 0135 mill.

By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form law. Total Excise Tax Due multiply line 7 by 035 thirty-five cents 8. Maine Amphibian and Reptile Atlasing Project MARAP Site Card.

Form 6478 Biofuel Producer Credit PDF. 95 95 ethanol X ethanol excise tax rate of 0198 01881 05 05 gasoline X gasoline tax rate of 0300 00150 02031. To find the MSRP if you do not have an existing registration on hand.

Blank forms schedules instructions fuel tax rates a list of licensed special fuel suppliers and other tax information. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

IFTA Fuel Tax Form 4th quarter 2020. IRP Application for Changes - Schedule C. IRP Uniform Distance Schedule -.

To find the MSRP of an existing registration. DYER LIBRARY SACO MUSEUM. 95 95 ethanol X ethanol excise tax rate of 0198 01881 05 05 gasoline X gasoline tax rate of 0300 00150 02031.

Form 8849 Claim for Refund of Excise Taxes PDF. Form 8821 Tax Information Authorization PDF. Real Estate Withholding REW Worksheets for Tax Credits.

Manufacturers suggested retail price MSRP How is the excise tax calculated. 18 rows The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation. Form 6627 Environmental Taxes PDF.

To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form. Publication 510 Excise Taxes PDF. Publication 3536 Motor Fuel Excise Tax EDI Guide PDF.

Return to MAINE REVENUE SERVICES PO BOX 1065 AUGUSTA ME 04332-1065. Visit the Forms and Pubs page. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves.

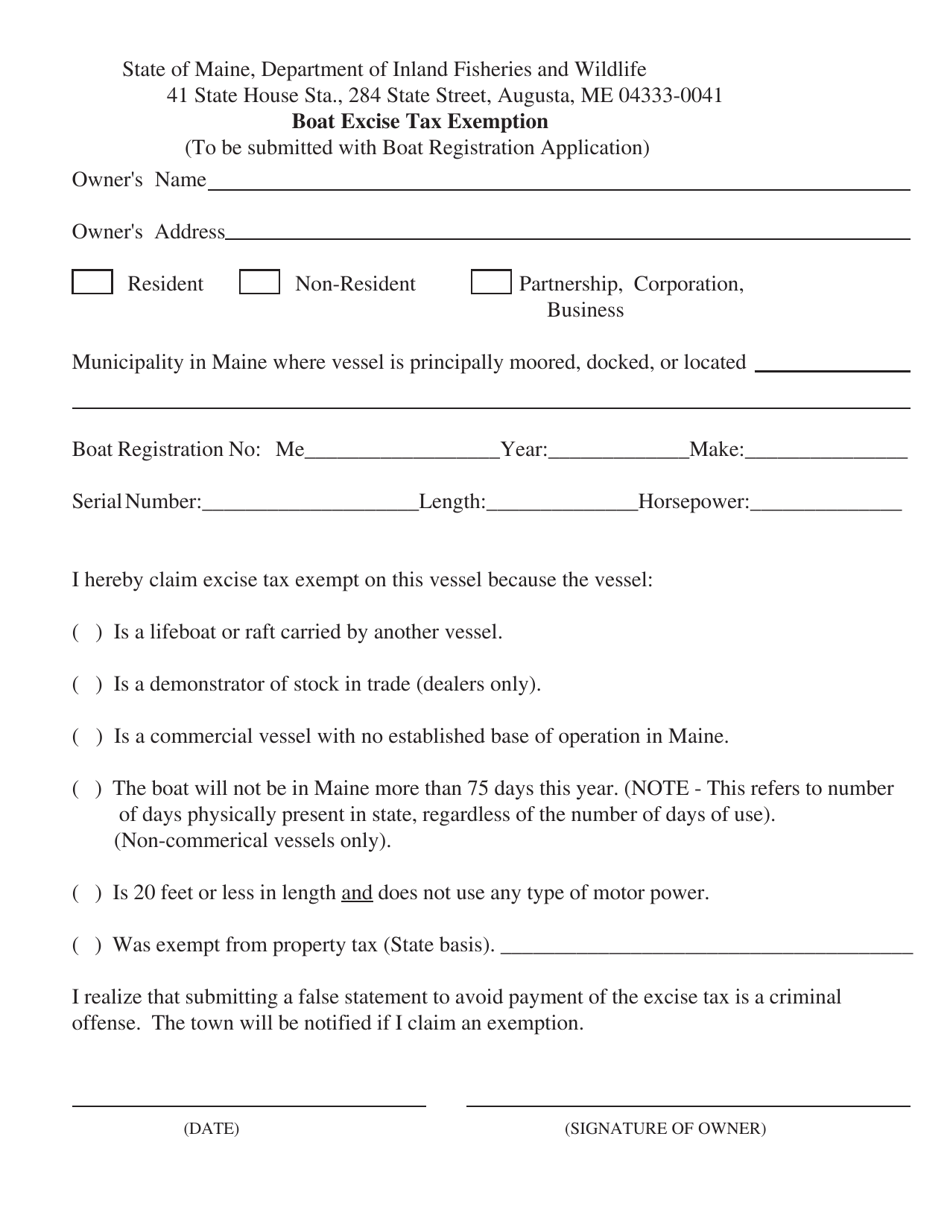

72 Consecutive Hour Trip Permit Application. Specific Instructions for the Marijuana Excise Tax Return Please note. Send a Schedule 1 electronically for each fuel type.

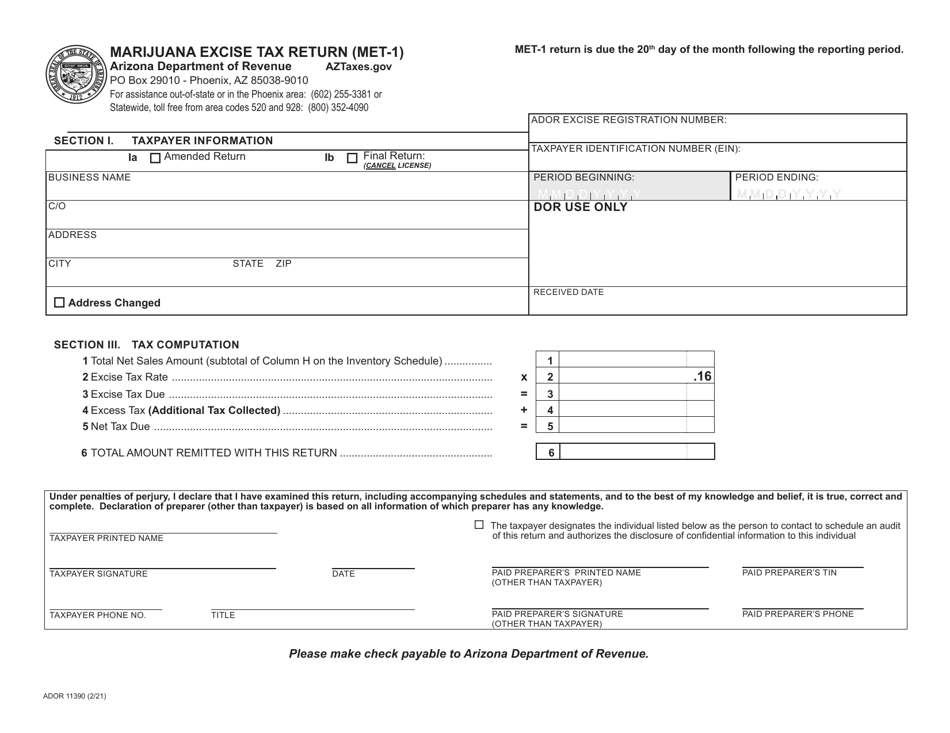

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form law.

You many be able to find the MSRP online at sites such as MSN Autos or Kelley Blue Book. See also additional excise tax below Maine manufacturer When selling low-alcohol spirits products to a. The state collects about 25 million in CFET tax each year.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Please record your registration number on your check. A credit for excise tax paid is taken on line 28.

YEAR 2 0175 mill rate. Multiply taxable gallons by the excise tax rate for the blend and enter the amount in the Tax column. IFTA Fuel Tax Form 3rd quarter 2020.

Electronic Request Form to request individual income tax forms. Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs. Enter on line 1a the total amount of.

This return must be filed even if there are no taxable sales to report.

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Form Met 1 Ador11390 Download Fillable Pdf Or Fill Online Marijuana Excise Tax Return Arizona Templateroller

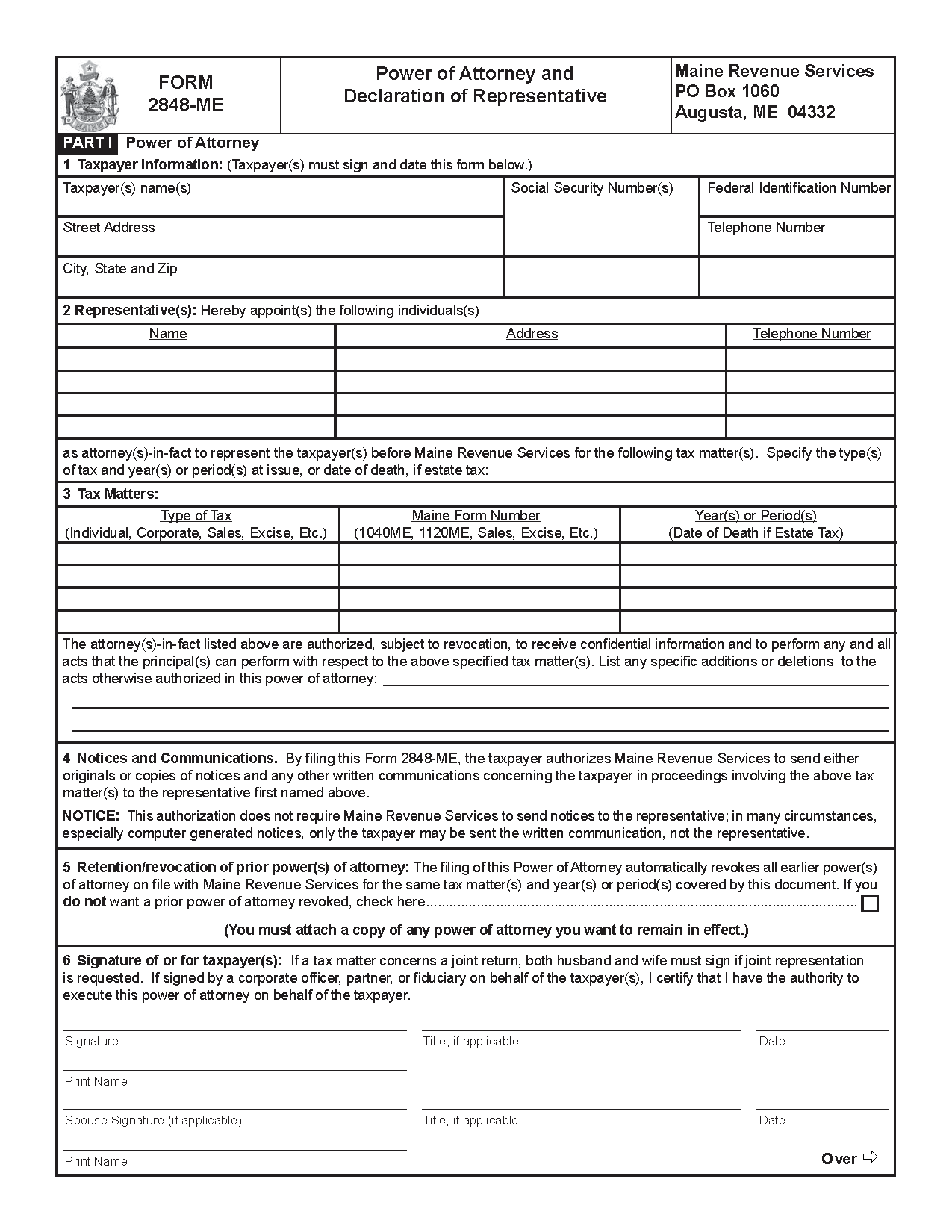

Free Tax Power Of Attorney Maine Form Adobe Pdf

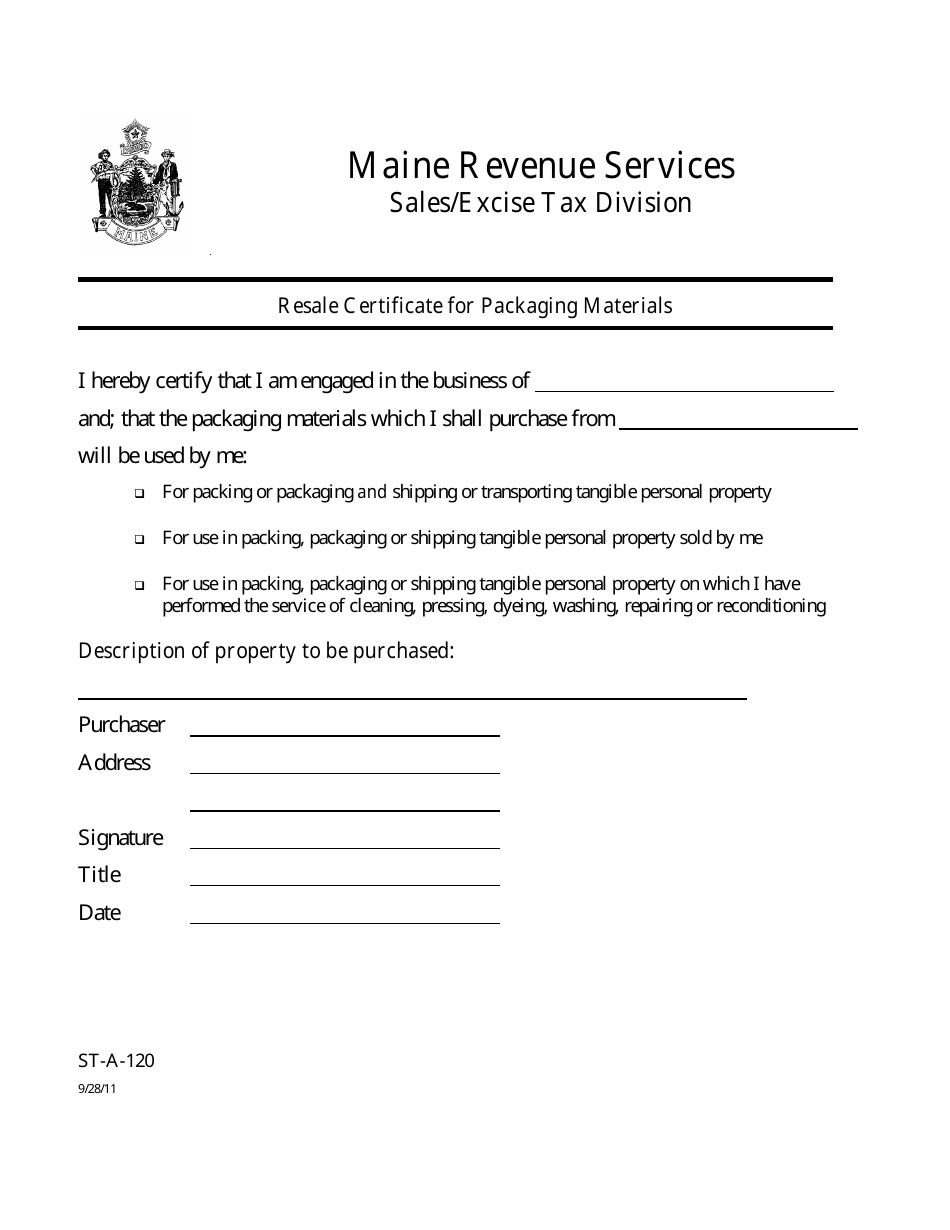

Form St A 120 Download Printable Pdf Or Fill Online Resale Certificate For Packaging Materials Maine Templateroller

Power Of Attorney Form 2848me Maine Gov

Form Gst Itc 1 Is A Quarterly Return True Or False A True B False Gstquiz Goodsandservicestax Gstfornewindia Aspireinstit True False Goods And Services

Excise Tax Information Cumberland Me

Free Maine Tax Power Of Attorney Form 2848 Me Pdf Word

Massachusetts Enacts Elective Excise Tax For Pass Through Entities Albin Randall And Bennett